A new year has arrived - and with it, comes reflection as to trends and opportunities in the world of private money, real estate bridge lending.

2016 was another active year for California hard money lenders and their investor borrowers. Low supply and strong buyer demand continues to drive appetites for buying, building, renovating, and selling residential and commercial property in both urban and suburban markets. And the trend that we have seen over the last several years of new capital sources entering the private lending space continues to expand as Wall Street and Internet firms have jumped in to create large Funds attempting to capture business not only in California, but nationwide as well.

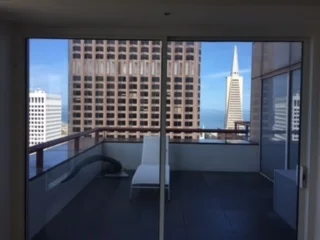

As a result of this infusion of new capital, firms like Equity Bridge Capital have had to rethink and adjust their business approach. Mainly, it's been all about getting back to basics with great results : focusing on familiar, local California markets like San Francisco, LA, Orange County, and San Diego to provide great service for customers in those markets, and continuing to provide loan products that the Big Box Funds typically cannot and will not provide - such as junior bridge loans ( this includes both 2nds & 3rds ) and construction loans ( for ground up and half-built, completion projects).

What will happen in 2017? A new administration, interest rate hikes, global and domestic security concerns, and a general, overall feeling that the bull markets ( both real estate and financial) seem logically vulnerable to a correction at some point in time is sure to create angst for some on both sides of a transaction. Yet, because of the volume and type of requests we are seeing, all factors seem to indicate that investor borrowers in 2017 will continue to seek leverage to take advantage of this unprecedented cycle and that private lending resources such as Equity Bridge Capital will continue to stand by, ready to assist investor borrowers who need bridge financing for their projects.

Equity Bridge Capital is a San Francisco based Private Money, Hard Money Real Estate Lending Company focused on providing bridge loans secured by both residential and commercial property in California. Our niche loan products include 1st, 2nd , and 3rd position loans, ranging from $200,000 - $10,000,000+ for all types of scenarios such as purchases, refinances, and construction projects. We offer competitive, customized terms - depending on the request. We work with all types of borrowers (good/bad credit, high/low net worth, high/low liquidity) and lend on all types of properties throughout Northern and Southern California - with an emphasis on San Francisco and the Bay Area, Los Angeles, Orange County, and San Diego.

For a quote or question about a loan, please fee free to contact Broker/Owner Art Gilberg at anytime, 7 days a week at:

Tel: 415-760-2338 or via Email: Art@EquityBridge.com

Equity Bridge Capital - Business Description: San Francisco hard money lender, private money loans, 1sts, 2nds, & 3rds, bridge loans, construction loans, equity loans, investor loans, business purpose loans, real estate loans, cross collateral loans, gap loans, San Francisco, Bay Area, Silicon Valley, San Jose, Marin County, Sonoma, Napa, Contra Costa County, Oakland, Berkeley, Alameda County, San Mateo County, Atherton, Palo Alto, Santa Clara County, Los Angeles, Orange County, San Diego - Art Gilberg dba Equity Bridge Capital , CA BRE#01868465